WHAT TO CONSIDER WHEN BUYING A PROPERTY

For most people, buying a home is one of the most important decisions of their lives. It is a great responsibility because it has a direct effect on your own finances and possibly on those of the rest of your family. The real estate market is becoming more and more expensive, as well as complex, so before signing any kind of property purchase, you must make sure you are aware of the checks that need to be carried out and the taxes that will also have to be paid when buying the property.

For that reason, together with our advice and assistance, here at the law firm FR&P we help you to understand all the procedure for buying a house, which usually tends to mortgage the buyer for almost their whole life.

Here at FR&P, we would like to suggest the following considerations when buying property in the Balearic Islands:

Purchase of a first home

- The area in which the property is located must be analysed in detail.In other words, you need to know the development perspectives of the area in which it is located and, at the same time, take into account if the property you’re buying will increase in value in the future.

- If you need to apply for financing to buy the house, banks are currently offering mixed-rate mortgages. During the first years of the loan they offer a fixed rate, which later becomes a variable rate. This option may be worth considering, since rates seem to be going down from the second half of the year, as hinted by the European Central Bank on April 11, 2024.

- You need to be properly informed to make sure that the construction company/developer that has developed, or is going to develop the construction project offers all the necessary guarantees and, most importantly, if it will respond with guarantees in the event of any incident once the property has been sold. In other words, you need to know in advance if the company from which you are buying the property is solvent and has a longstanding business record, especially to avoid future conflicts.

- As far as taxes are concerned, it should be noted that:

-

- The buyer of the property has to pay 10% VAT to the seller. It is paid directly on the day you sign the purchase before the notary. Then, it is declared by the seller in the corresponding VAT return. Any prepayments made will also carry the corresponding VAT, i.e. 10%.

- The buyer must pay and settle a 1.5% stamp duty (in Spanish, Actos Jurídicos Documentados) or 2.00% if the purchase price is over one million euros. The term is 1 month from the date of signature of the deed of sale.

Purchase of an urban plot

- Analyse the area in which the property is located, i.e. what the development prospects are and therefore, whether it will increase in value in the future.

- If applying for third-party financing, banks are currently offering mixed-rate mortgages, i.e. during the first years they offer a fixed rate, which later becomes a variable rate. This option may be worth considering, since rates seem to be going down from the second half of the year, as hinted by the European Central Bank on April 11, 2024.

- Get a proper analysis/advice from a good firm of architects as to whether or not you can actually build and what you can do exactly. On many occasions, these types of plots are advertised on large real estate platforms, stating that the plot is urban when in fact it isn’t. It is important to bear in mind that building on a site where it is not permitted can lead to financial and even criminal penalties.

- Analyse the availability/feasibility of water and electricity.

- Request several quotations from construction companies and compare prices.

- As far as taxes are concerned, it should be noted that:

- If the seller is considered a business or a professional, they have to pay 21% VAT. It is paid directly on the day you sign the purchase. Then, it is declared by the seller in the corresponding VAT return.

- If the transaction is subject to VAT, you will also have to pay and settle 1.5% stamp duty (in Spanish, Actos Jurídicos Documentados) or 2% if the purchase price is over one million euros. The term is 1 month from the date of signature of the deed of sale.

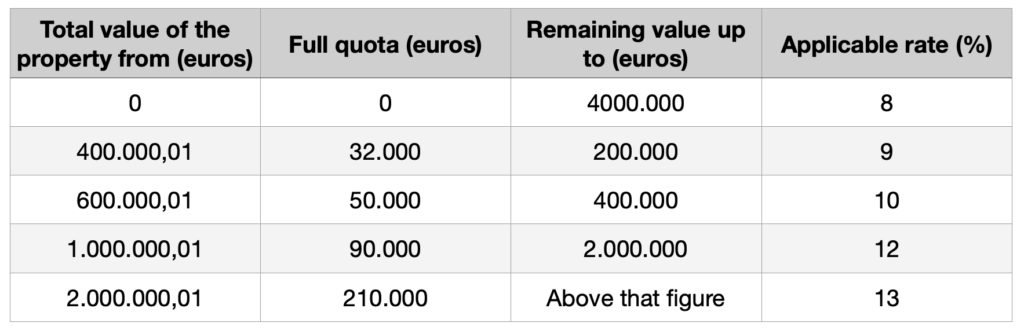

- If the transferor/seller is a private individual, i.e. not a business or a professional, the buyer has to pay property transfer tax (in Spanish, transmisiones patrimoniales onerosas), which ranges from 8% to 13% depending on the value of the property:

If the transaction is subject to property transfer tax, there is no VAT or stamp duty. They are not compatible.

Similarly, the term for paying and settling the property transfer tax is one month from the date of signature of the purchase.

Here at our law firm, we recommend that, before they sign the purchase of a property, our clients should seek the necessary advice to avoid problems in the future. Our firm has specialists who can always advise and defend our clients in such important financial transactions.